I get lots of input from many sources, and one of the ones I like is the innovation survey of banking produced annually by EFMA with Accenture. It also usually proves to be one of the most read items on my blog – here’s the 2015 and 2016 reports – so, as I know you like it too, here is this year’s perspective of banking start-ups and innovation.

Digital attackers are actually a great opportunity for banks by Ambrogio Terrizzano, Antonio Coppolecchia, Carlo Bonini, Giulia Ropolo – Accenture Interactive

Attackers vs incumbents. It all started with an announced Armageddon.

Digital attackers’ stories are pervading the financial services debates worldwide, with discussions mainly focused on the disruption threat these players represent for incumbents. But looking at this phenomenon more in detail, it is possible to highlight how events and figures don’t support this frightening scenario, opening the doors to terrific opportunities for incumbents.

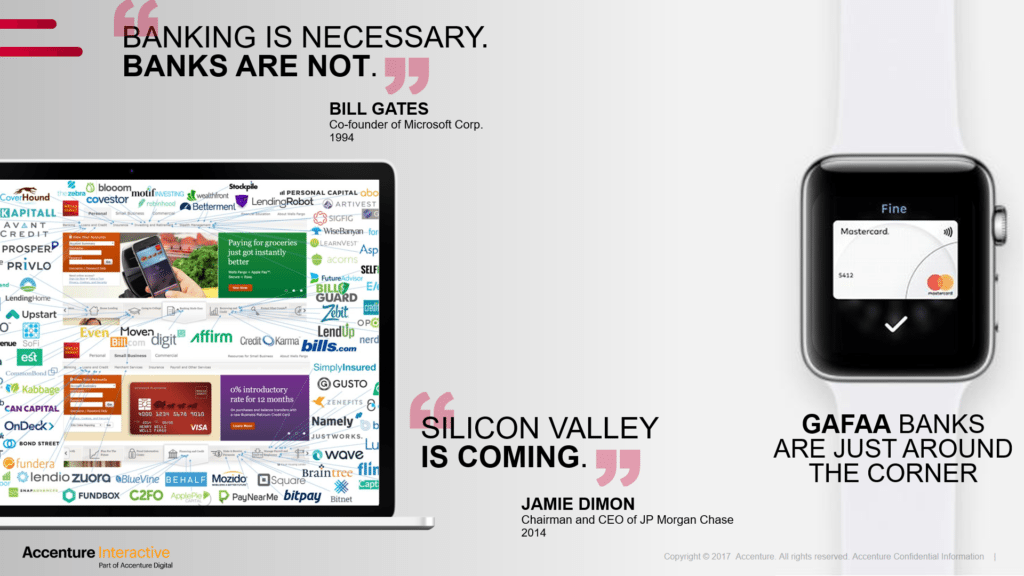

At the very first stage of the “digital attackers’ era”, quite a few industry experts, financial gurus and bankers themselves all agreed that the banking industry was on the brink of collapse; the root cause was the rise of fintech companies ready to “attack” banks on specific offering verticals. In the same way, a consistent number of initiatives put in place by GAFAA (Apple/ Android Pay or Amazon Lending are probably the most known) contributed to the spread of a sentiment of fear among incumbents.

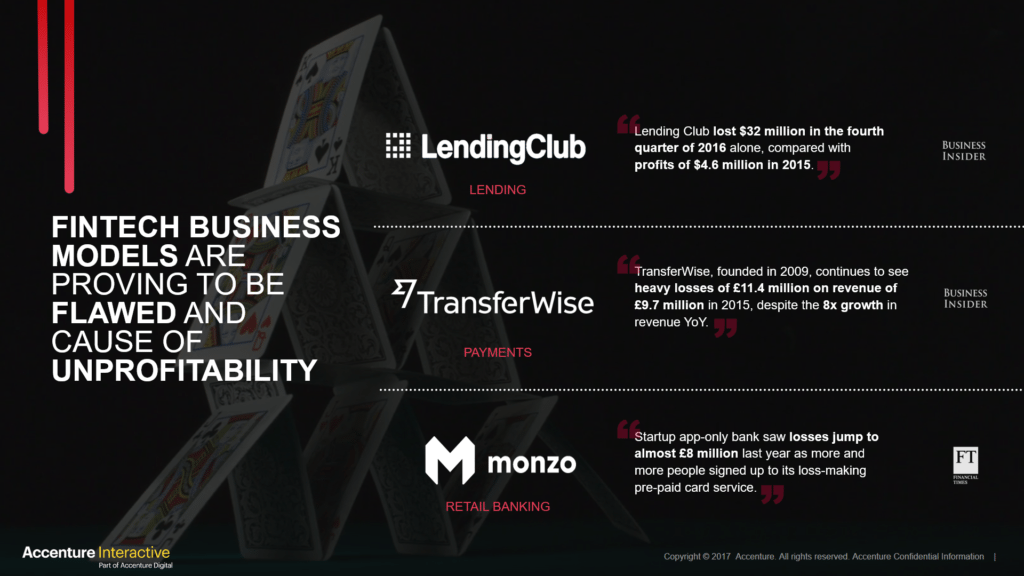

But it’s been a while now and some facts have revealed that the threat posed by fintech might have been overestimated: according to a recent Business Insider report, the great majority of fintech still have weak business models that prevent them from reaching stable profitability. It may sound hard to believe, but TransferWise, the most used money transfer service worldwide, has reached operational profit only this year, for the first time since its launch in 2009. Likewise, GAFAA are very cautious when it comes to enter the banking arena, since they all know that profit can be extremely narrow in the industry.

Having said so, it is clear the digital attackers’ journey has just begun and there are several evidences that should be taken into consideration when analyzing the disruption new entrants are bringing to banking.

A sigh of relief. In a brand new world.

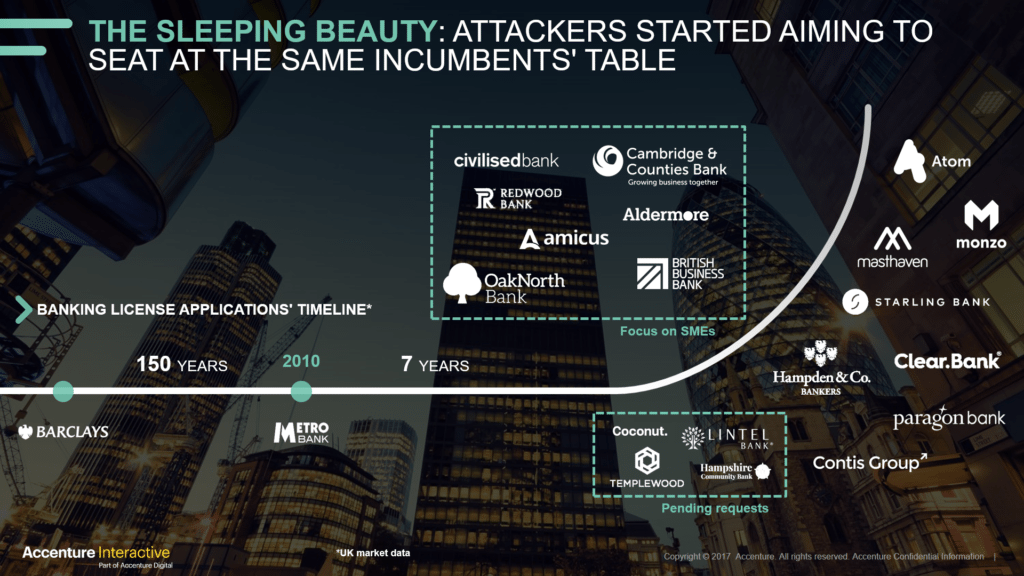

First of all, the number of attackers interested in competing on equal terms with banks is rising at an unprecedented pace: the foremost example is the UK banking market, where the number of banking license applications has surged in the last 7 years, seeing at least 15 new players entering the incumbents’ ground after Metro Bank paved the way in 2010. This is the case of Atom, Monzo and Starling Bank, the leaders of the new breed of 100% digital UK banks.

From a regulation point of view, PSD2, at least in the dear old Europe, is playing a pivotal role in the market evolution trajectory towards an open arena, giving customers full control over their money as well as giving third parties access to their accounts. As suggested by Tom Blomfield, CEO of Monzo, “the bank of the future will be a marketplace”. We would add that incumbents should get ready to move accordingly.

Another fact able to reshape or shake the industry is the rise of chatbots and conversational interfaces as new interaction paradigm. They’re not just a possible solution to lower customer service costs. They are a terrific tool to engage with customers in a complete new way, being exactly where they want banks to be. This is another area where digital attackers are stepping into. Banco Original, for instance, has developed a Facebook Messenger chatbot to help and guide customers during the onboarding and key information gathering process.

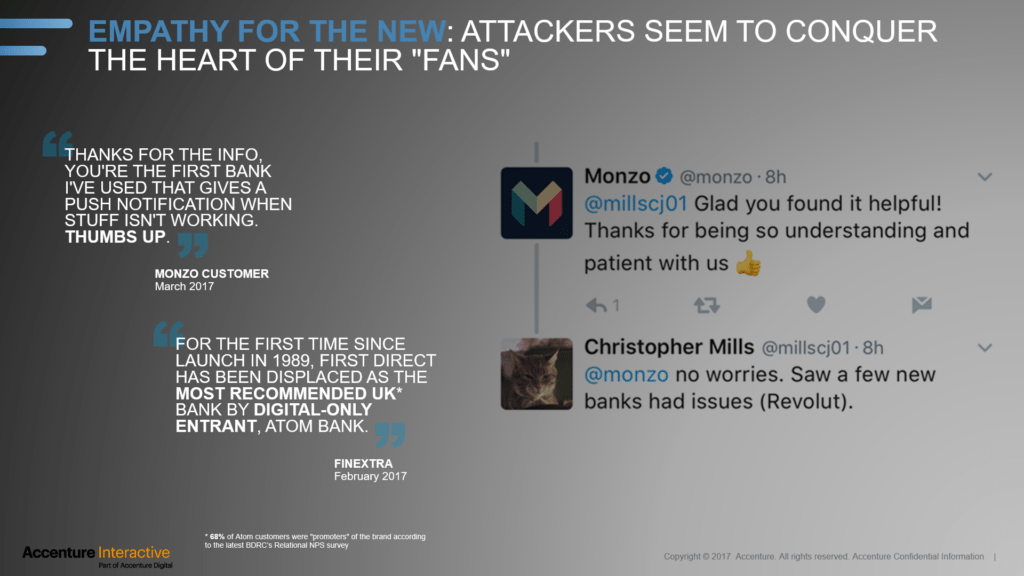

Last but not least, we can’t ignore digital attackers’ ability to “conquer customers’ hearts”: customers seem to feel a higher degree of empathy for these new players, rewarding their extreme attention and transparency with a very indulgent and supportive approach. Great examples come again from the UK, where Atom Bank, a so-called challenger bank, has displaced First Direct as “Most recommended bank” for the first time since the incumbent’s launch in 1989. Having said that, there are anyway good news: disruptors’ stories are all but secret.

Like any other recipe, even the attackers’ one is made of simple ingredients. To achieve the best possible result, it is pivotal to know the ingredients, their properties and how to make them “work” together.

“We are what we repeatedly do. Excellence, then, is not an act, but a habit” (Aristotle)

The first ingredient disruptors have in common is their ability to be and stay consistent. An iconic example may clarify this concept: think about James Bond. Back in the ‘60s, 007’s producers picked the 360-degree brand factors that had to characterize James Bond; his self-introduction, Vesper Martini always ordered as a drink are just the first examples everybody may remind. And they kept using them all over years until today, depicting an ever-unique story for spy lovers from all over the world.

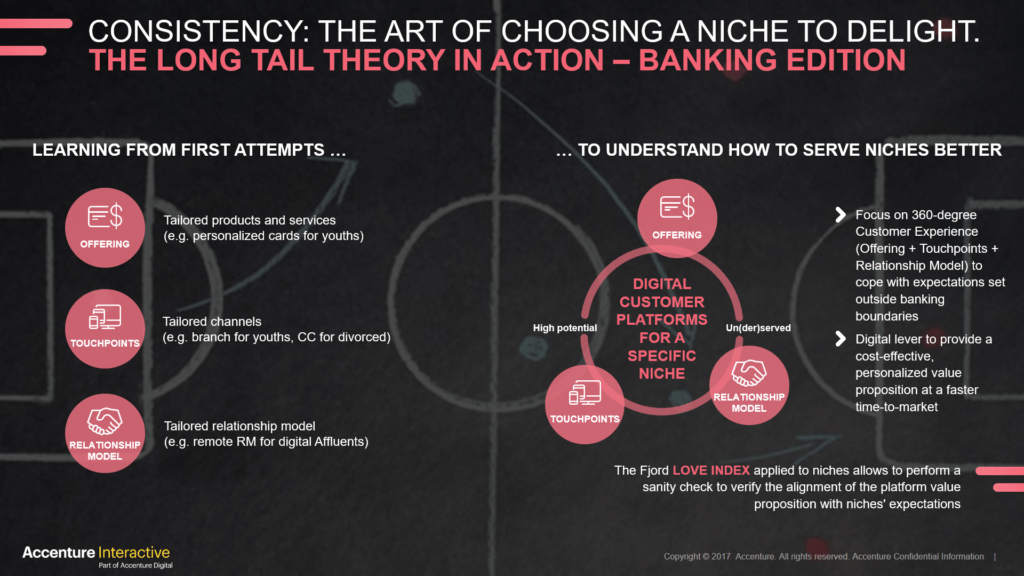

In the very same way, disruptors have proved to be great examples of consistency, since they focus on finding a specific niche to delight. By moving from an asset-based segmentation and offerings (i.e. products for mass, affluent, business customers) to mindset and lifestyle-driven ones, some digital attackers have built digital customer platforms, a powerful combination of tailored offering, touchpoints and relationship model, thus enabling a 360-degree customer experience. And as Chris Anderson’s “Long Tail” theory explains, this wouldn’t be possible without the digital lever.

The number of digital attackers born and raised courting a niche is growing fast and Europe seems to be their preferred habitat: Idea Bank for scale-ups in Poland and Monese for expats in the UK are common examples. Another interesting case is Revolut, the Londoner fintech addressing the needs of businesses and individuals with a “global lifestyle”.

On the incumbents’ side, only few banks have started following and they’re mainly from Spain: Imaging Bank from CaixaBank is one of the most interesting cases within the youth banking arena, whereas Santander’s 1|2|3 Mini is a dedicated value proposition for parents and their kids. BBVA, instead, acquired the Finnish fintech Holvi offering basic financial solutions and interesting value-added services to sole traders.

For those incumbents willing to develop their consistency capability, few steps are needed: first things first, they should start by choosing their battleground, identifying a high potential/ un(der)served niche among their customer base. Then they need to build a coherent branding and communication strategy fostering the niche-specific value proposition, reinforcing it through a supportive culture.

“Coming together is a beginning, keeping together is progress, working together is success” (Henry Ford)

Openness is for sure the second ingredient we spotted. As mentioned before, disruptors are natively willing to integrate with other external providers to improve their offers. Google Home with its smart devices ecosystem is probably one of the best example of this attitude, along with Bla Bla Car that has recently introduced a ride-sharing dedicated insurance together with AXA and different “car-as-a-service” packages, partnering with ALD Automotive.

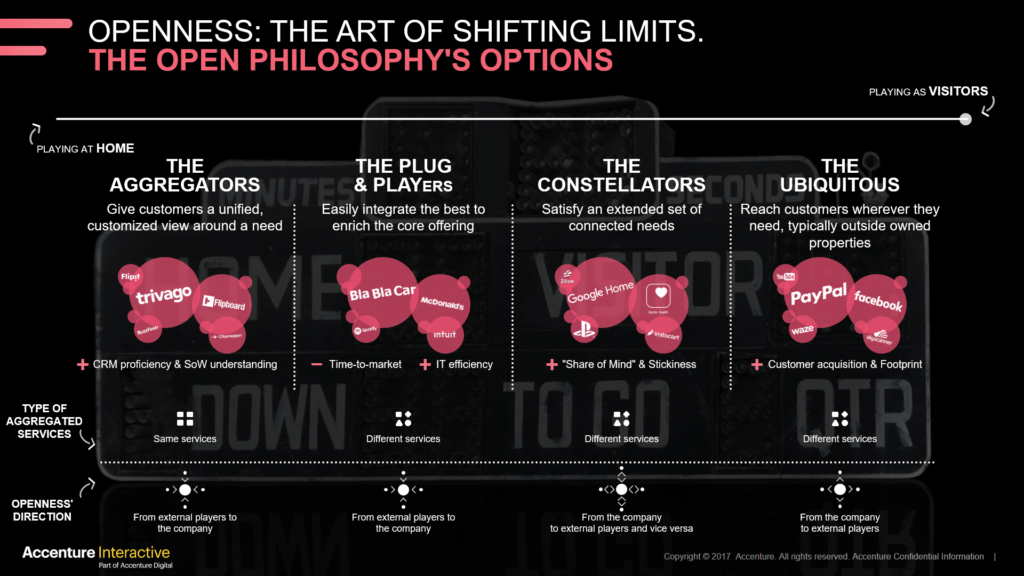

According to the type of aggregated services and the openness’ direction (i.e. how far from internal boundaries the partners are), it is possible to identify different open philosophy’s options. Trivago-like companies giving customers a unified, customized view around a need can be considered as pure Aggregators. Those companies that bring third parties inside with limited integration effort, such as in the

Bla Bla Car example above, can be named Plug&Players. Google Home strategy’s fellows, which aim to satisfy an extended set of connected needs might be considered as Constellators. Last but not least, we can find the Ubiquitous players, the ones that reach customers wherever they need - typically outside owned properties - and integrate part of their capabilities and assets within external companies’ systems. All these options have a specific benefit, ranging from the increase in the CRM proficiency and SoW understanding for Aggregators, up to the rise in customer acquisition and footprint for the Ubiquitous.

But also among digital attackers it is possible to perceive different shades of openness: Starling Bank, for instance, is been developing a marketplace to integrate into its proprietary app products and services from third-party providers. The German Fidor Bank, since the very beginning of its operations, has decided to leverage API-based partnerships to speed up the launch of new products and has now established its own marketplace for financial services called "Finance bay", where customers can navigate through its partners' products and for example choose their favorite loans. Conversely, solarisBank can be considered among the Ubiquitous, offering a modular-based banking toolkit, with a banking and e-money license, to provide players from different industries with custom-fit solutions.

Back to incumbents, some relevant examples emerged as well. BBVA is one of the few banks that decided to give access to its API Market to businesses and startups, allowing them to integrate banking services into their legacies and applications. ING has gained ground in the SME digital lending by partnering with Kabbage, whereas mBank with its mRaty solution has extended its distribution network, letting customers apply for a loan directly on 3rd parties’ eCommerce platforms as payment option, without entering the bank’s website.

After analyzing these expected and unexpected moves, it seems that the openness pioneers and believers accepted the challenge to shape (or reshape) their IT by leveraging API as new mantra and moved the dear old finances much far from the boundaries they’ve been till today.

“Design is not just what it looks like and feels like. Design is how it works” (Steve Jobs)

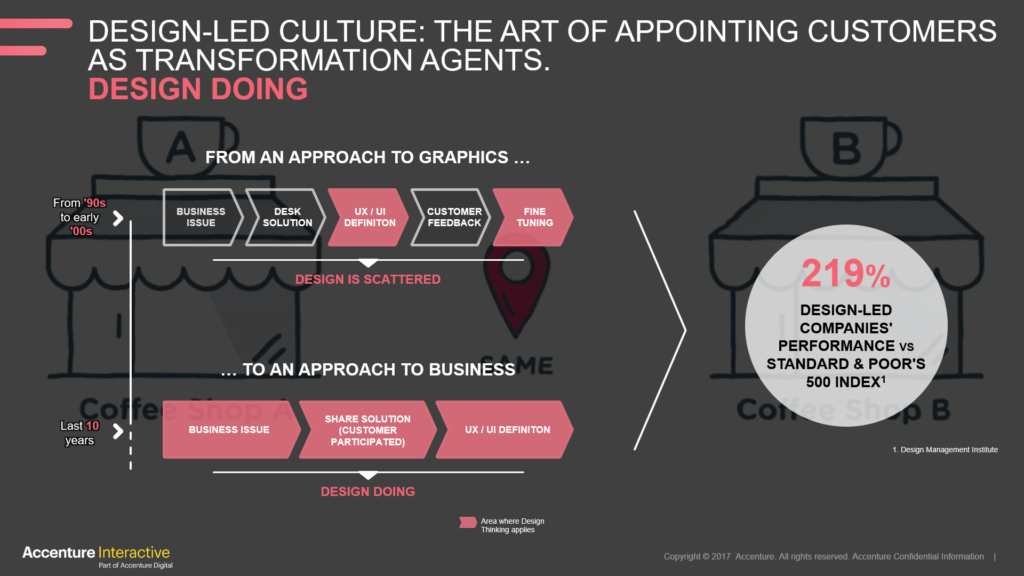

The last bit of our recipe is the digital attackers’ reliance on a design-led culture. As a matter of fact, the popularity of the design thinking approach is still rising and more and more players are adopting it in their path towards customer centricity. Real-life examples come from iconic companies like Samsung and P&G that, thanks to customer interviews and ethnographic researches, deepened their understanding of customer needs, thus developing better products and reaching record sales levels (the Swiffer ideation story is something worth reading!).

The art of appointing customers as transformation agents and the shift from a scattered implementation of design to a pervasive adoption of the design thinking across all processes and company departments have proved to be a winning strategy: according to the Design Management Institute, design-led companies outperform S&P by 219%.

Back to financial services, there are quite a few interesting cases that demonstrate digital attackers didn’t lag behind other industries’ players. A bold case comes from US where Robinhood is reimagining the overall investing experience, from the moment users sign up for an account to the moment they place the first free trade. Its commitment has been so high that it became the first finance company in history to win an Apple Design Award (does anybody still remember the times of “banking is boring” belief?).

Meanwhile in Germany N26’s motto speaks for itself: Banking by Design. As a matter of fact, the Pan-European neobank has a precise goal: setting new standards for user experience in banking by working relentlessly on simplifying everyone's financial life and by addressing smartphone users' specific habits and needs. And they have reached 500k customers in 17 countries in just three years since the launch.

Banco Original is another digital attacker particularly committed to design. To actualize this commitment, the Brazilian bank has established a special team within its Strategy and Innovation Department. The team is formed by a few members (“no more than the number of people you can feed with two pizzas”, an executive said), thus gaining flexibility and speed in the design of new solutions.

What about incumbents? Different players have applied different strategies to make design part of their culture. Capital One, for instance, decided to boost its design transformation journey by acquiring user experience design firms. Commerzbank, instead, has worked hard to set up an in-house design agency to improve the pace and quality of digital implementation. Last but not least, Commonwealth Bank of Australia is refining its design-led culture every day, applying a customer-led listening approach to define new solutions and, at the very same time, infusing collaboration, commitment and co-creation across all bank's departments.

The examples from our last ingredient have taught us that a design-led player always acts backed-up by findings, that means actually listening to customer needs and expectations every time a decision has to be taken. In addition, it focuses on making the design culture real and tangible for everybody in the organization. In a nutshell: design thinking supported by design doing.

“To succeed, jump as quickly at opportunities as you do at conclusions” (Benjamin Franklin)

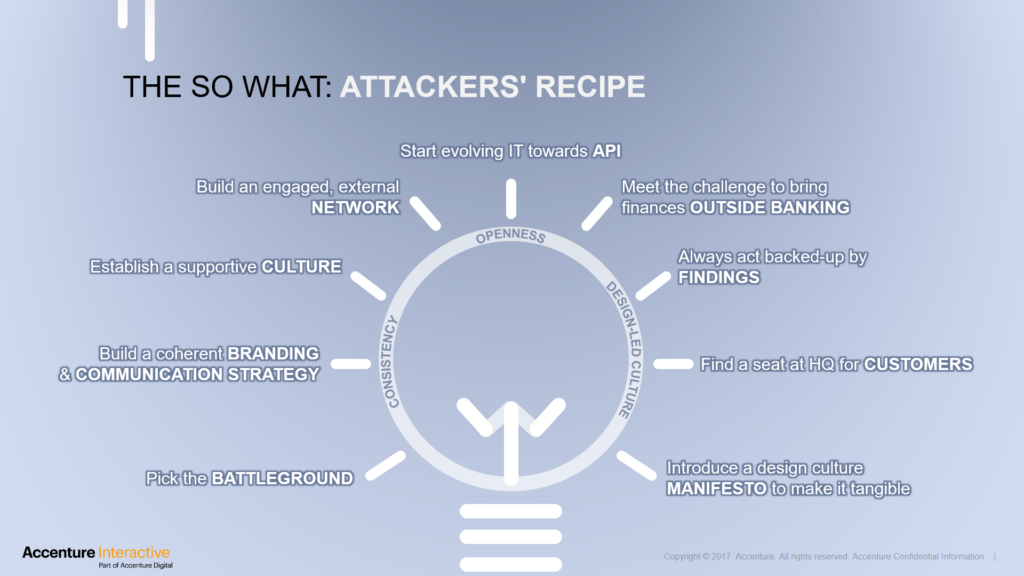

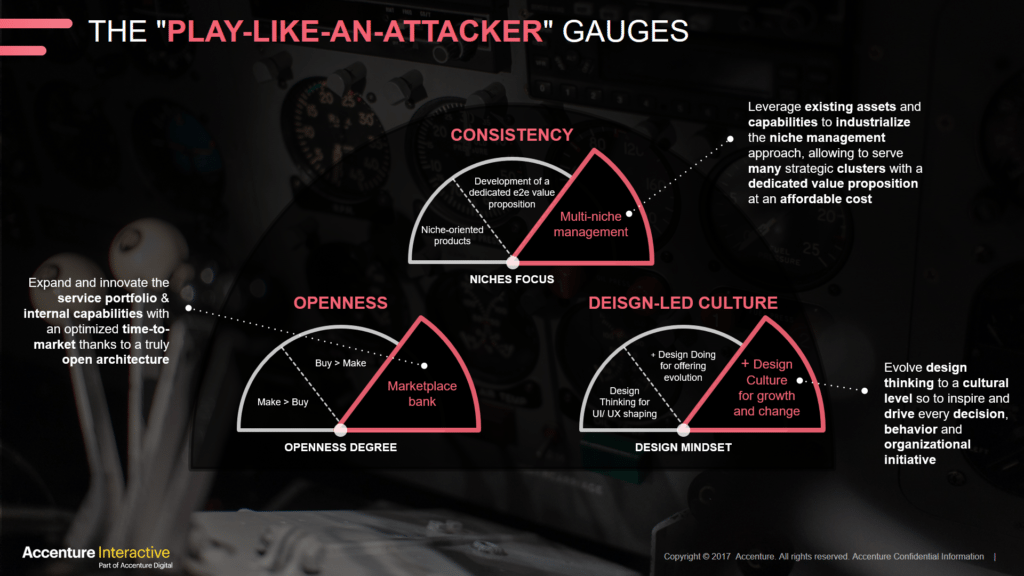

We saw that digital attackers are characterized by three strategic areas of focus: attention to addressing niche-specific needs, a certain degree of openness and a real design mindset. We can imagine each of those strategic areas as made of different levels of proficiency, representing a natural evolution path. For what concerns focus on niches, for example, a player may just start with niche-oriented products, or it can move a step forward developing an end-to-end value proposition. And once it has acquired a proven methodology, it might be able to implement a profitable multi-niche management, leveraging existing assets and capabilities to serve many strategic clusters in parallel at an affordable cost.

The same considerations apply to the openness’ degree: here the finish line is becoming a marketplace bank, relying on a truly open architecture to expand and innovate the service portfolio and internal capabilities with an optimized time-to-market. Similarly, the ultimate degree of a design mindset is the evolution of design thinking to a cultural paradigm so to inspire and drive every decision, behavior and organizational initiative.

What we have just described makes it clear for established banks that attempting to play a different game is definitely worth the effort and technology state-of-the-art is supportive. But stories in the market show that attempting without strategy is not enough. Playing the transactional game revealed to be a poor move as many attackers’ examples show, while trying to address a much broader set of customer needs is the key for making the effort profitable, such as Idea Bank and its many value-added services demonstrate. Another key lesson is that being afraid to open the doors to external network is no longer an option. Thinking of new solutions every day or week or month is not profitable when all answers are already there and wait for “open minds” to leverage them. Of course, pushing forward the “usual stuff” does not and can’t mean following any opportunity, option or customer target in the market.

In the beginning the niche to address can be small, but it must be widespread, as economies of scale (and profit) are not going to disappear in the new scenario!

And, much more important, believing in this new path is vital. And when a bank invests all in pursuing the new opportunities and accept to infuse it into its DNA, communicating the difference delivered should not be missed.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...