Banks and startups are headed toward the same goal from different starting points.

Each side is increasingly seeking to package automated investment advice with checking because customers are expressing an interest in getting both services from one provider.

Sometimes they are rivals, sometimes they are working as partners, and sometimes the lines are unclear.

Fifth Third Bancorp's securities unit

The Silicon Valley-based robo-adviser Wealthfront is looking into offering its customers checking and savings as well. Wealthfront spokeswoman Kate Wauck confirmed that it recently surveyed customers to gauge interest in having a cash account that has the features of a regular savings account.

First reported by Bloomberg News, Wealthfront’s proposed account would have a similar interest rate to that of a savings account. Direct deposit would be available, customers could instantly transfer money between this account and other Wealthfront accounts, and a “virtual card” would be associated with the new account.

“Controlling clients’ free cash is often critical to both locking in the client relationship and even gaining more share of wallet from said clients,” said Chip Roame, managing partner of Tiburon Strategic Advisors. “I note that the Wealthfront account specifically is testing the instant movement of cash between accounts. That’s very savvy.”

Roame said the move by startups to offer customers checking and savings (microinvesting app Stash also

“As opposed to clients storing cash in money market funds on which the firm might charge a 50 basis point operating expense ratio, discount brokerage firms like Charles Schwab and TD Ameritrade moved trillions of dollars to safer, FDIC-insured bank accounts, on which the firm might gross a 200- to 300-basis-point spread between deposit and loans,” Roame added. “It’s very profitable.”

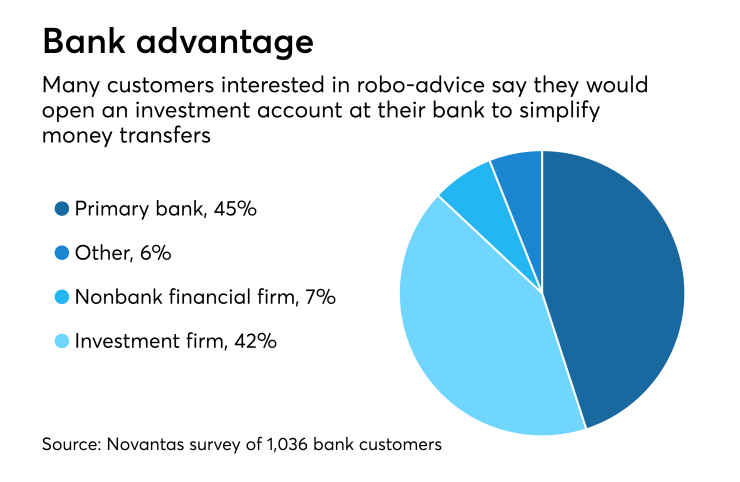

Another reason firms should blend robo-advice offerings with banking is that customers are more likely to select a digital investment option from their primary bank, according to the retail bank consulting firm Novantas.

In a survey of over 1,000 respondents done in December with the adviser software firm SigFig, Novantas found that 68% of bank customers were very interested or extremely interested in opening an automated investing account and 45% would do so with their primary bank. The top reason for doing so, survey respondents said, was for ease in transferring money between accounts.

That trend is pushing the "platformification" of financial services, said April Rudin, founder and CEO of the Rudin Group, a wealth marketing firm.

“Consumers don't want to go to multiple platforms to connect with individual financial services that can be offered on one platform,” Rudin said. "Just like cellphones began as a one-trick pony that could only make calls, they are now multifunctional devices. Wealth management or banking or payments will all be aggregated as 'platformification' becomes more pervasive.”

The convergence in offerings follows another trend: According to Novantas, robo-advice will reach $1.5 trillion in assets by 2020, with the lion's share coming from the coveted millennial investor demographic.

There is however a risk for banks launching digital investment offerings, observers note; more wealthy clients could be turned off if there are not similar digital options tailored for their more complex wealth needs.

Eve Kaplan of Kaplan Financial Advisors in Berkeley Heights, N.J., said the move by digital-first wealth management firms into bank accounts makes sense, pointing to Fidelity, where she keeps an account.

“It’s not anything new for a company to go into this area, certainly not a threat to a registered investment adviser like my own firm. Opening a bank account, a checking account, these are convenience items,” she said. “They are just trying to spread their operations across to capture idle money.”