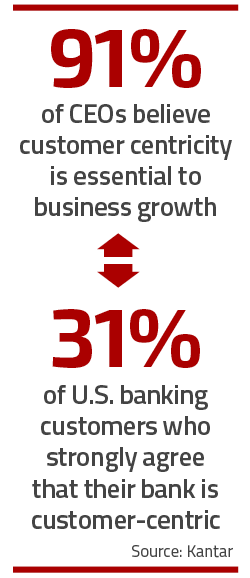

Today’s consumer follows a multi-directional path to purchase, with their combined experiences determining what they buy, how much they engage and how loyal they become. Now, for the first time, there is statistical evidence of the connection between the experience a consumer has with your financial brand and the revenue impact on your financial institution. In other words, the success of your organization in the marketplace has become increasingly reliant on how you manage customer experiences.

For the past several years, the Digital Banking Report has found that “improving the customer experience” is both a major trend in the banking industry and a major strategic objective for the majority of banks and credit unions. Unfortunately, research also indicates that most financial institutions talk more about improving customer experiences than investing in ways to remove friction, increase engagement and motivate employees towards this goal.

For the past several years, the Digital Banking Report has found that “improving the customer experience” is both a major trend in the banking industry and a major strategic objective for the majority of banks and credit unions. Unfortunately, research also indicates that most financial institutions talk more about improving customer experiences than investing in ways to remove friction, increase engagement and motivate employees towards this goal.

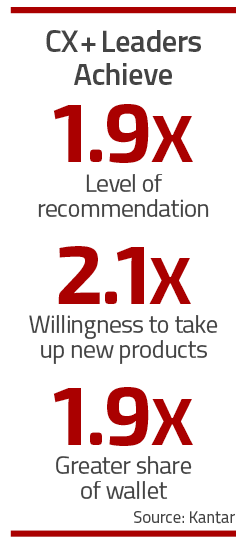

Now there is an extra motivation to do the right things for consumers. In a study from Kantar, it was found that financial institutions that lead in customer experience (CX) have a higher recommendation rate, a higher share of deposits, and a greater likelihood that customers will increase their portfolio of new products and services from their bank. Conversely, it was found that financial institutions that let their customer experience decline risk losing up to 12.5% of their share of deposits.

Interestingly, while improved customer experience can benefit financial services companies across the board, the opportunity is even more important for female consumers, according to the research:

- 61% of female bank customers stay with their bank for more than five years, as on the whole they are less satisfied than men.

- Women have a lower preference score for their bank than men (65 for women vs. 76 for men), indicating that they may be more willing to switch if a better alternative presents itself.

- Women are also less willing than men to take up additional products or services with their bank (64.3% vs. 73% of men).

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Connecting the Dots Between Digital and Human

At a time when technology has simplified and improved almost every component of a consumer’s life, it has also increased the amount of “noise” in the marketplace, as messages are delivered across all platforms and channels. Choice has become overwhelming and most organizations have failed to provide unbiased recommendations at the time the consumer needs them most.

The reality is, many organizations have simply increased the number of times they bombard consumers with irrelevant messages. Making matters worse, organizations have failed to deliver consistent and contextual experiences across the channels consumers use most.

“One of the paradoxes of digital is that more digital has meant more demand for all things human and analog.” – J. Walker Smith, Chief Knowledge Officer, Brand & Marketing at Kantar Consulting

As was found in the research conducted by the Digital Banking Report and sponsored by the BAI entitled, “Humanizing the Digital Banking Experience,” the demand for digital is increasing at the same time that people are demanding experiences that are more engaging, more meaningful and more “human.”

Kantar summarizes the keys to an improved experience in banking in five takeaways:

- One size doesn’t fit all. To succeed, financial institutions must find ways to customize, personalize and create advocacy from under-served consumers.

- Banking doesn’t have to be boring. Banking is a lifestyle choice. Consumers want to do business with banks and credit unions that are engaging, innovative and simple to use.

- Use the data advantage. Financial institutions have an advantage when it comes to building a 360-degree view of the customer. Every little improvement in customer experience will pay dividends.

- Know your brand. Organizations must find ways to differentiate their brand on service delivery, transparency, advice, responsiveness, etc. as opposed to price, product and location. This brand message must be understood by both customers and employees.

- Look Beyond Banking. “Delivering exceptional experiences requires continual learning, and continual improvement,” according to Kantar. “It is essential to look outside your industry bubbles to understand what best-in-class truly looks like.”

Closing the Customer Experience Gap

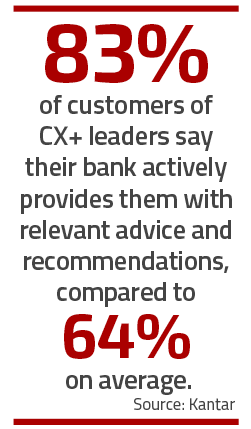

According to Kantar, the roadmap to customer experience growth is based on clarity of brand promise, empowerment of employees and customers, the ability to create lasting memories, and exceptional delivery. To be a truly customer-centric organization, a bank or credit union must consider how experiences align (or don’t) with the promises made to consumers. The difference between an organization’s brand promise and the actual customer experience delivered is referred to by Kantar as a bank’s Experience Gap.

To determine the impact of Experience Gaps on real organizations, Kantar talked with more than 6,000 consumers nationwide. It combined the CX performance score of leading banks with their Experience Gap to determine Experience Advantages, or CX+. Not surprisingly, USAA topped the rankings based on its ability to deliver superior customer experience in line with its brand promise. Regions Bank, Chase, BB&T and Citizens Bank comprised the remainder of the top five retail banks.

“Truly customer-centric organizations take it a step further and align their customer experience with their brand promise,”states Erika Pearson, EVP Customer Experience at Kantar. “The proof is in eight of the top ten banks that make up our CX+ ranking. They show a positive experience gap, which means they are delivering a great customer experience that exceeds their brand promise.”

Understanding What’s Important

The Kantar research found that all too often existing CX programs within financial institutions are focused more on eliminating pain points, rather than creating and delivering positive experiences that can build long-lasting relationships. This aligns with research done by the Digital Banking Report, that found that most institutions think resolving problems quickly is the most important satisfaction metric. This is despite the reality that less than 2% of customers experience a problem with their bank that needs resolution.

The Kantar research found that all too often existing CX programs within financial institutions are focused more on eliminating pain points, rather than creating and delivering positive experiences that can build long-lasting relationships. This aligns with research done by the Digital Banking Report, that found that most institutions think resolving problems quickly is the most important satisfaction metric. This is despite the reality that less than 2% of customers experience a problem with their bank that needs resolution.

“To create memorable customer experiences, banks should consider all touchpoints in the customer journey and find the right balance between humans and technology,” states Erika Pearson. “Nearly half of U.S. banking customers who are Centennials [Generation Z] or Millennials believe that their bank cuts corners with automated services. It’s more important than ever to put your customer first and ask yourself: ‘Will using this technology solve a genuine customer need’?”

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Using a Personalized CX Approach

In the research, it was found that regional banks such as Regions, BB&T and Citizens had achieved higher overall scores than the mega-banks such as Citibank or Wells Fargo. Kantar believes this confirms the benefit of community presence in terms of convenient location (not a major driver of loyalty) and in the regional banks’ ability to identify with customers and their specific needs.

Understanding specific customer needs across different demographics is a critical element to exceeding customer expectations. But financial institutions must also avoid generalizations, since the ways consumers do their banking is not fully dependent on their demographic segment.

Thinking outside of traditionally accepted generalizations can uncover opportunities for growth that may be underserved. This includes Millennials and other underbanked segments. As mentioned above, the Kantar study also found that while women may be perfectly confident with everyday finance, they’re not

necessarily happy with their bank. “Banks that choose to be proactive in engaging more effectively with their female customers, and pay closer attention to meeting women’s needs, will benefit from tapping into the potential of this valuable and under-served market,” the study states.

The Job Is Never Done

For the first time, there is statistical proof of the ultimate cost of sub-optimal customer experiences — as well as the money being left on the table if you don’t meet or exceed your customers’ expectations. With most organizations looking for ways to improve efficiency ratios, improving the customer experience can reduce the cost of customer acquisition, improve the return on investment for customer engagement and reduce attrition.

For the first time, there is statistical proof of the ultimate cost of sub-optimal customer experiences — as well as the money being left on the table if you don’t meet or exceed your customers’ expectations. With most organizations looking for ways to improve efficiency ratios, improving the customer experience can reduce the cost of customer acquisition, improve the return on investment for customer engagement and reduce attrition.

While improving the customer experience is certainly not as easy as flipping a switch, the financial impact of improving this metric certainly is worth prioritizing and investing in. But the biggest challenge facing banks and credit unions trying to make improvements in customer experiences is that the job is never done. Even for best-in-class organizations, resting on their laurels is not a good path.

Listening to customers, measuring the right components of satisfaction and acting upon what consumers tell you is critical for banks and credit unions that want to ensure CX differentiation and financial success.