Savings accounts that offer generous interest rates are emerging as a key battleground for financial upstarts. US robo-advisor Betterment is the latest to offer consumers a higher rate than they can get from a typical bank.

The company is rolling out a savings platform that offers a 2.69% annual percentage yield, which is higher than the leading rate for US accounts shown right now on Bankrate.com of about 2.5%. Later this year, Betterment plans to start a federally insured checking-account service with no fees or minimum account balances. It will include a debit card that reimburses ATM fees.

Betterment’s foray into savings products follows the launch of a similar offering in February from robo wealth-management service Wealthfront, which offers a rate of 2.57%. The brokerage app Robinhood announced a savings product last year that wasn’t vetted by regulators and had to be retracted.

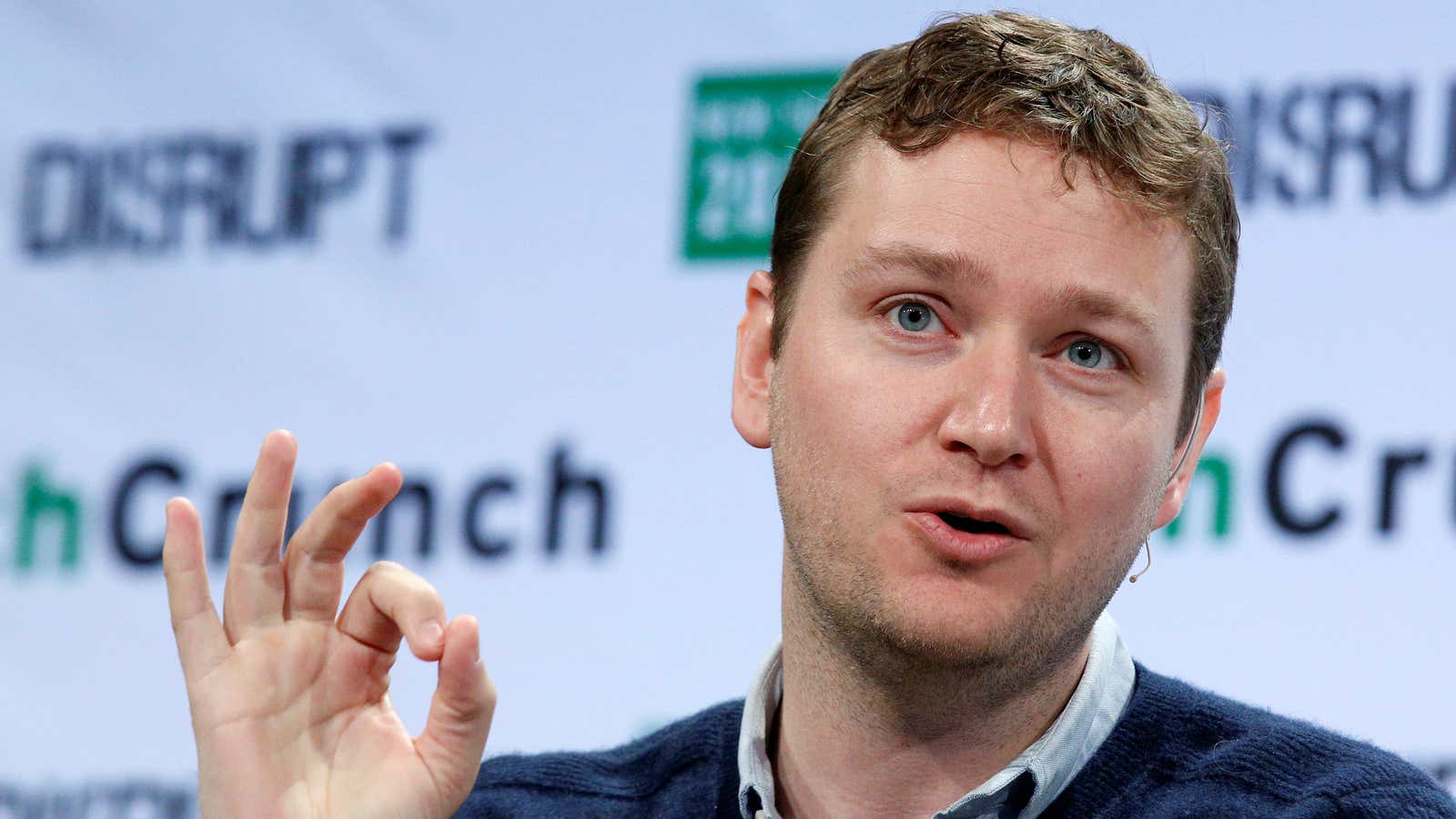

Betterment CEO Jon Stein said the goal isn’t to make money directly from the saving product itself. In their quest to scale up, fintechs like Betterment see these high interest-rate offers as a way to attract new customers that they will hopefully be able to cross sell other products. The New York-based robo advisor charges 0.25% of assets annually for its online wealth management (for clients with less than $2 million in assets); customers can get access to calls with human advisors for a charge of 0.4%.

Could this eventually pose a challenge for large traditional banks? Their business model relies in part on cheap capital from deposits that they then lend out at higher interest rates.

It’s worth remembering that Betterment won’t be cutting banks out of the loop. Its checking product will be provided by nbkc bank, a Federal Deposit Insurance Corp. (FDIC) member in Overland Park, Kansas. The company’s savings platform will deposit customer money into its FDIC-insured bank partners (there are currently at least four, which is how it is able to offer up to $1 million in deposit insurance). Wealthfront’s savings product also relies on white-labelled bank partners.

This shows that banks aren’t necessarily being stripped out of the digital, mobile-first financial world. Even so, if fintechs like Betterment, which has more than 450,000 customers, and Wealthfront, with some 270,000 accounts, successfully make the savings deposit market more competitive, it could erode a profit engine for financial industry stalwarts.