Stock Exchanges Lead in Blockchain Adoption: JP Morgan Report

by Fintechnews Switzerland March 18, 2020Blockchain has not yet reached mainstream adoption in the financial services industry but the technology has nevertheless moved beyond experimentation and is rapidly being adopted by stock exchanges around the world, according to a report by JP Morgan.

In a paper titled Blockchain, digital currency and cryptocurrency: Moving into the mainstream? the bank explores the state of blockchain and cryptoassets adoption, and shares predictions for what to expect in the near future.

According to the report, payments, trade finance and custodian services remain the clearest use cases for distributed ledger technology (DLT) and blockchain, and stock exchanges are rapidly adopting the technology to improve efficiency around settlement and clearing, as well as collateral management.

2019 was marked by several developments in this regard, the paper says, citing examples such as Deutsche Boerse rolling out a DLT solution for frictionless collateral swaps in the securities lending market, and Boerse Stuttgart launching a first of its kind digital asset exchange platform called BSDEX. Both initiatives were launched in December.

2019 was marked by several developments in this regard, the paper says, citing examples such as Deutsche Boerse rolling out a DLT solution for frictionless collateral swaps in the securities lending market, and Boerse Stuttgart launching a first of its kind digital asset exchange platform called BSDEX. Both initiatives were launched in December.

In Switzerland, the SIX Digital Exchange (SDX) introduced in September a prototype of what it claims to be the world’s first end-to-end platform for digital assets. The full launch is expected in Q4 2020.

2019 also saw the traditional capital markets continuing to adopt of blockchain. State Street teamed up with cryptocurrency exchange and custodian Gemini Trust to integrate Gemini’s digital asset custody solutions into State Street’s investment reporting. QME, the commodity trading platform of the Hong Kong stock exchange, partnered with Ant Financial to integrate warehousing and logistics using blockchain to provide transparency for the entire lifecycle of a commodity.

Despite these recent developments, JP Morgan believes widespread implementation of blockchain solutions in traditional banking will likely take three to five more years and will be concentrated in trade finance and payments.

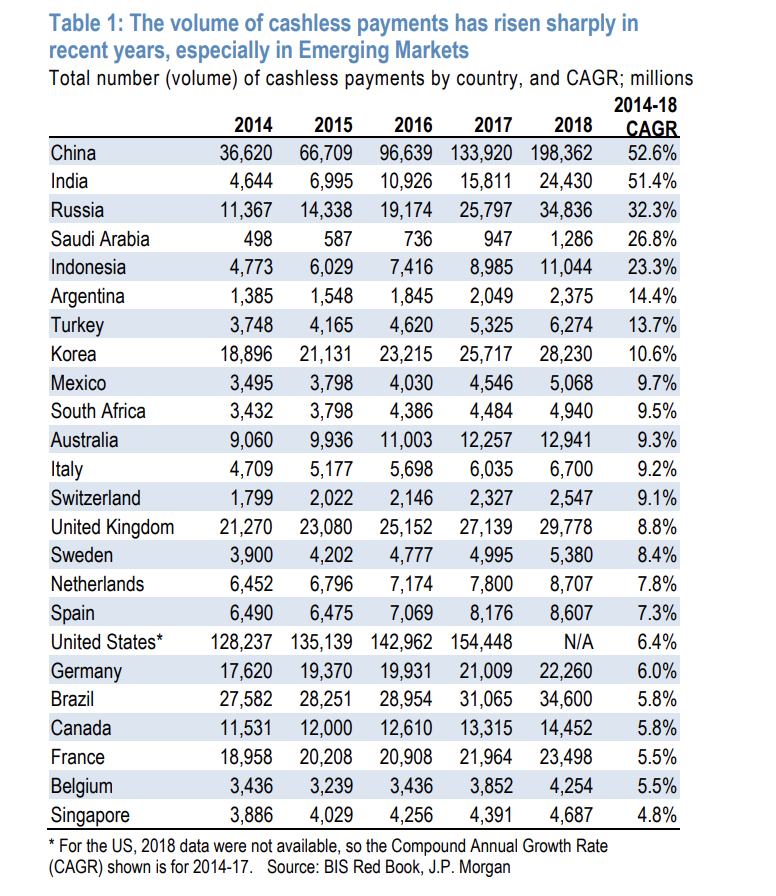

2019 also witnessed the rise of alternative payments, a trend driven by Asia and the region’s explosion in third-party and mobile providers, the report says. In China and India, the volume of cashless payments increased more than five-fold between 2014 and 2018, the report notes, adding that the value of e-money transactions in China has surpassed those worldwide of Visa and Mastercard combined.

Cashless payments has also grown rapidly in Japan with credit card payments driving the rise and QR code payments growing the most, the report says. This growth has been driven by the government’s push, and the momentum is expected to continue in the year to come, it says.

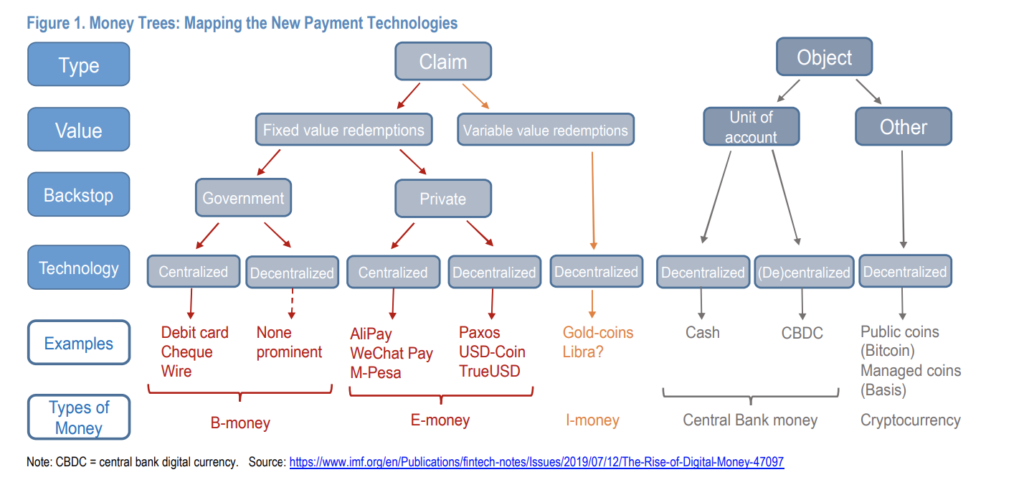

As the global payments landscape evolves, the research looks at the emergence of stablecoins. According to the paper, stablecoins and Libra, in particular, have the potential to grow substantially, and while JP Morgan argues that “the world is ready for private money,” the need for appropriate regulatory oversight and challenges inherent to the technology including energy requirements must be resolve in order for stablecoins to gain rapid adoption and scale.

As the global payments landscape evolves, the research looks at the emergence of stablecoins. According to the paper, stablecoins and Libra, in particular, have the potential to grow substantially, and while JP Morgan argues that “the world is ready for private money,” the need for appropriate regulatory oversight and challenges inherent to the technology including energy requirements must be resolve in order for stablecoins to gain rapid adoption and scale.

For a stablecoin like Libra to succeed, it says, they will require short-term liquidity facilities, a source of positive-yielding reserve assets, and less distributed, semi-private networks.

As for the cryptocurrency market, the paper notes that the market continued to mature in 2019 with participation by financial institutions increasing and new contracts on regulated exchanges. One of the most notable developments, it says, is the launch of options on bitcoin futures contracts by CME in January 2020. Institutional trading platform Bakkt, a subsidiary of Intercontinental Exchange, was the first to launch regulated bitcoin options contract back in December 2019.

Featured image credit: Pixabay