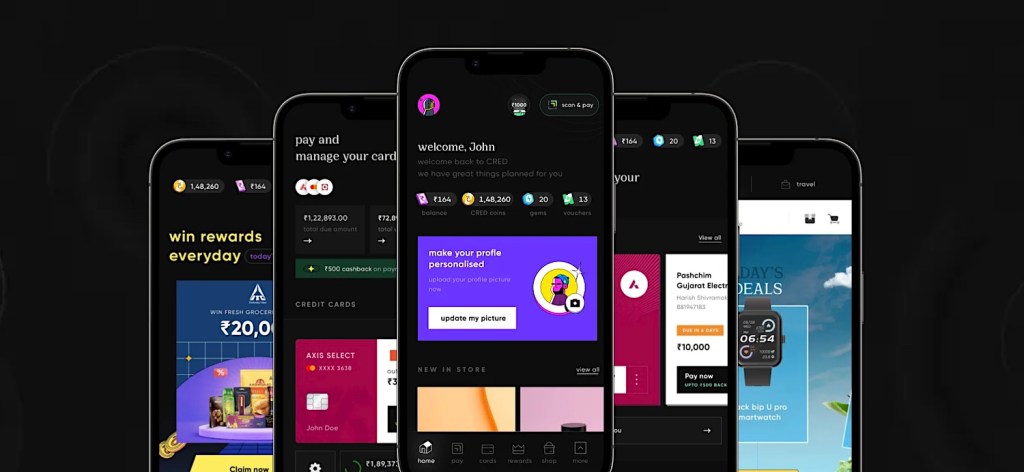

CRED is rolling out a buy now and pay later service and a tap to pay feature as the Indian fintech platform broadens its offerings to boost engagement and monetization on the platform.

Cred flash, the Bengaluru-headquartered startup’s foray into the buy now and pay later category, will allow customers to make seamless payment on the app and across more than 500 partner merchants, including Swiggy, Zepto and Urban Company and clear the bill at no charge in 30 days.

The customized credit extended to customers will allow them to make bill payments and recharges and other expenses with a single swipe and without having to wait for an OTP authentication code, said the startup, which is valued at over $6 billion. The service, powered by RBI-registered NBFC Parfait Finance and Investments Pvt Limited, will initially roll out to a select group of customers, the startup said.

The BNPL product is the latest in a series of new offerings from CRED in recent years as it moves to make its eponymous fintech app a bigger part of its customers’ lives.

The startup, which also offers its customers the ability to lend to one another on the platform at “inflation beating” rates, last year launched Scan and Pay, its fast UPI QR payments that allows customers to earn rewards for each transaction they made to merchants and also protect their identity by using aliases.

CRED, which has amassed 16 million users, started its life as a utility tool for tracking and paying credit card bills. It serves some of India’s most trustworthy customers as the app only onboards those who have at least a 750 credit score. This threshold has made CRED a more feasible testbed for additional financial services, even if those offerings have existed on other platforms for years.

A handful of startups in India offer buy now and pay later services, but many of the prominent names in the category, including Zip-backed ZestMoney, are struggling financially as they mostly cater to an audience base with thin credit bureau history.

Tech and VC heavyweights join the Disrupt 2025 agenda

Netflix, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just a few of the heavy hitters joining the Disrupt 2025 agenda. They’re here to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch Disrupt, and a chance to learn from the top voices in tech — grab your ticket now and save up to $600+ before prices rise.

Tech and VC heavyweights join the Disrupt 2025 agenda

Netflix, ElevenLabs, Wayve, Sequoia Capital — just a few of the heavy hitters joining the Disrupt 2025 agenda. They’re here to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch Disrupt, and a chance to learn from the top voices in tech — grab your ticket now and save up to $675 before prices rise.

CRED said it is also rolling out a tap to pay feature that will allow users to make payments through their credit cards with their phones with a tap on the terminal machine. The feature, first rolling out to NFC-enabled Android smartphones, will require members to unlock their phone before they tap on the merchant’s PoS machine.

“Tap to Pay addresses CRED members’ need for a fast, simple, and safe offline payment experience. Tap to Pay uses secure card tokenization technology to store card tokens on the device,” the startup said.

The startup, backed by Sequoia India, QED, Tiger Global and Ribbit, is aggressively focusing on growing its revenue as it fires up more monetization engines, its founder and chief executive Kunal Shah said earlier this year in an interaction. “Members are engaged in multiple products. And, the monetization is kind of setting us in the right direction,” he said.