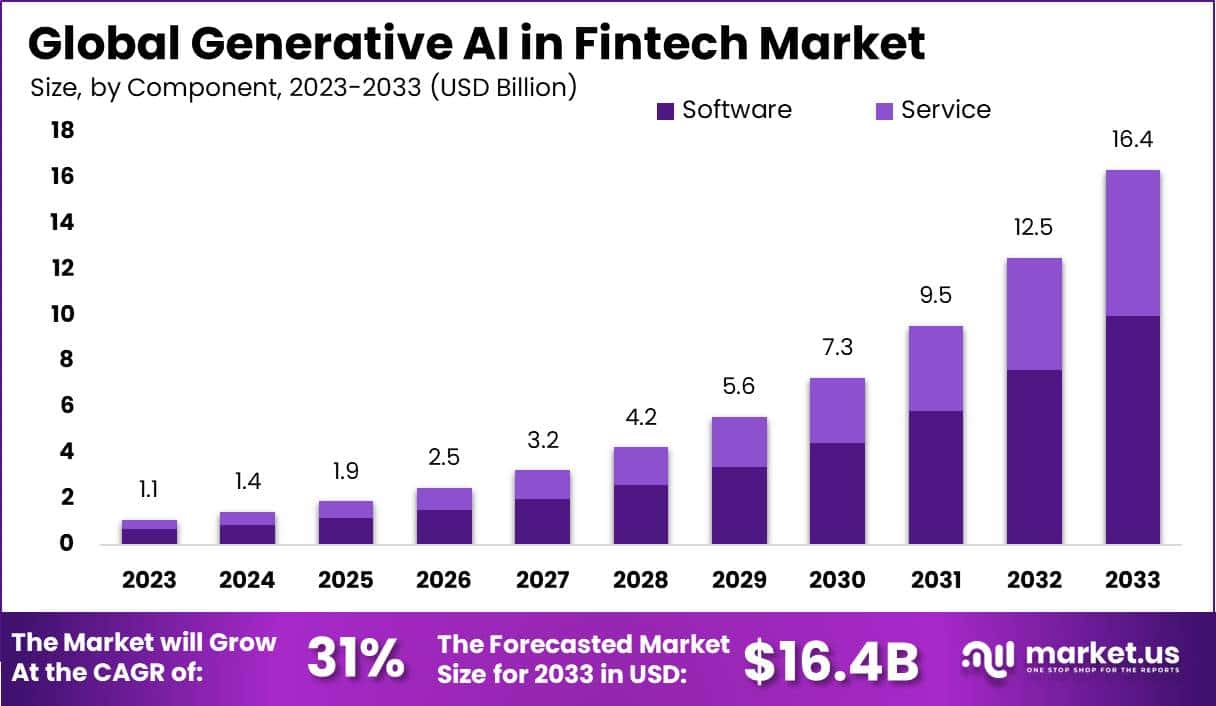

New York, April 03, 2023 (GLOBE NEWSWIRE) -- Market.us forecasts that the Generative AI in Fintech Market will exceed USD 6,256 million by 2032, rising from USD 865 million in 2022. Furthermore, it is anticipated to achieve a Compound Annual Growth Rate (CAGR) of 22.5% between 2023 and 2032.

The global generative AI in fintech market was worth USD 865 million in 2022. The use of generative AI is primarily surged by credit card fraud detection. Using Generative Adversarial Network, AI can spot the difference between hacked data and real data in every transaction and send alerts to the banks. The biggest challenge faced by the majority of fintech companies with generative artificial intelligence is the sensitive issue of data security and privacy. The fintech industry is governed by strict rules and regulations since any security and data breach failure could be destructive.

Get additional highlights on major revenue-generating segments, Request a Generative AI in Fintech Market sample report at https://market.us/report/generative-ai-in-fintech-market/request-sample/

Key Takeaway:

- By component, the software segment held a dominating revenue share in 2022.

- By deployment, the on-premises category had the highest revenue share in 2022.

- By application, the compliance & fraud detection segment held the largest share in 2022.

- North America held a revenue share of approximately 37% in 2022

- Asia Pacific market is expected to record the fastest-growing CAGR during the forecast period.

Generative AI has boosted the tech industry by permitting companies to automate complicated processes. The major reason for the evolution of machine learning is cost reduction, reduced human errors, improved customer experience, and improved efficiency.

Factors affecting the growth of Generative AI in Fintech Market

Several factors can affect the growth of generative AI in fintech market. Some of these factors include:

- Cost-effectiveness: Generative AI in fintech allows companies to reduce their cost by automating their processes and cutting down the possibilities of errors usually made by humans. Generative AI is empowering small finance companies as it is affordable and has fewer chances of error occurrence. This is a big plus for the development of the market.

- Improved work efficiency: Generative AI not just helps in reducing costs but also in reducing working time, with fewer human interventions. This saves time, which is the most important for all types of fintech companies, as it also saves costs in the long term.

- Technological advancements: New technology such as robo-advisors keep surveillance on the stocks, events, price trends, and bonds according to users’ needs which helps them make suggestions and decisions regarding the stock about to be bought or sold. These technological advancements drive the adoption of generative AI in Fintech market.

To understand how our report can bring a difference to your business strategy, Inquire about a brochure at https://market.us/report/generative-ai-in-fintech-market/#inquiry

Top Trends in Global Generative AI in Fintech Market

The growing popularity of generative AI in fintech assists chatbots in holding efficient conversations and boosting customer satisfaction, leading to market growth. The growing perception of generative AI in the fintech industry for synthetic data generation, fraud detection, trading prediction, and risk factor modeling drives market growth. The significant growth in the IT sector with increasing usage of generative artificial intelligence integrated systems over various verticals for increasing productivity and sharpness is primarily propelling the global generative AI in fintech market.

Market Growth

Multiple companies use generative AI Chatbots as customer assistants for sales, online chat executives, and customer care executives. The significant details about cash flow and expenses are gaining momentum from the end user as this helps industries to reduce their expenses. This also saves time compared to when humans did it. This is a major factor impacting the market growth positively.

Regional Analysis

North America leads the generative AI in fintech market by accounting for a major revenue share of 37%. The growth of the North American region is due to many startups and key players offering generative AI services to financial services. The increasing adoption of generative AI in fintech by various businesses in the region is driving the growth of generative AI in fintech market in the North American region. The major applications include business analytics & reporting, virtual assistant, and customer behavioral analytics.

Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period. The growth of the Asia Pacific region is attributed to the rising demand for generative AI-based solutions in the region. In addition, many businesses are adopting generative AI in fintech, fueling the growth of generative AI in the business market of the region.

Competitive Landscape

The competitive landscape of the market has also been examined in this report. The generative AI in fintech market is fragmented into many companies. Key players in the generative AI in fintech market are focusing on different strategies to expand their market share across various regions. Strategies like collaboration, partnership, merging, and acquisition are adopted by the companies. Some of the major players include Open AI, Microsoft Corporation, Google LLC, Genie AI Ltd., IBM Corporation, MOSTLY AI Inc., Veesual AI, Adobe Inc., Synthesis AI, Paige.AI, Rephrase.ai, and Other Key Players.

Have Queries? Speak to an expert or Click Here To Download/Request a Sample

Scope of the Report

| Report Attribute | Details |

| Market Value (2022) | USD 865 million |

| Market Size (2032) | USD 6,256 million |

| CAGR (from 2023 to 2032) | 22.5% from 2023 to 2032 |

| North America Revenue Share | 37% |

| Historic Period | 2016 to 2022 |

| Base Year | 2022 |

| Forecast Year | 2023 to 2032 |

Market Drivers

The Generative Artificial Intelligence (AI) in fintech will allow companies to reduce their cost to automate their processes and cut down the possibilities of error. Generative AI empowers small finance companies as it is affordable and has fewer chances of error occurrence. Multiple companies use generative AI Chatbots as customer assistants for sales, online chat executives, and customer care executives. The essential details about cash flow and expenses are gaining momentum from the end user as this helps industries to reduce their costs.

Market Restraints

Loan decisions constructed data generated by generative artificial intelligence is hard to audit, which may hurt loan decisions. In addition, rules and regulations are continuously improvising; generative AI cannot examine and process the proper regulatory environment. Finally, Generative AI won’t be able to train the trading algorithm, as markets are highly unpredictable.

Market Opportunities

Advanced technology such as robo-advisors keeps surveillance on the stocks, events, price trends, and bonds according to the user’s needs. This helps them make suggestions and decisions regarding the stock about to be bought or sold. It plays a crucial role in risk management, network security access to big data, speech recognition, etc. These technological developments will create a new opportunity for generative AI in fintech market.

Grow your profit margin with Market.us - Purchase This Premium Report at https://market.us/purchase-report/?report_id=99019

Report Segmentation of the Generative AI in Fintech Market

Component Insight

Based on components, the market is divided into software and services. The software segment recorded the largest revenue share in 2022 and is expected to dominate the market over the forecast period. The growth of the software segment can be registered to factors like growing false activities, unexpected outcomes, overestimation of capabilities, and rising concerns about data privacy.

Deployment Insight

Based on deployment on-premises segment has dominated the generative AI in fintech market. However, the cloud deployment model is expected to grow significantly during the forecast period. Generative AI is developing, and its influence may be significant during the forecasted period. With the adoption of generative AI in the finance sector, many startups are competing with major players. Exponential growth is expected in the fintech industry with the development of technologies, such as cybersecurity and blockchain, with generative AI.

Application Insight

The compliance & fraud detection segment held the largest share, followed by business analytics & reporting in the market in 2022. Generative AI is used to find the relation between global events and their impact on prices using predictive analysis. Generative AI in financial services is essential to protect the details of customers. Generative AI plays a crucial role in assessing algorithms from fraudulent cases. It is also used to advise accurate results. P2P organization analyzes its potential customer’s behavior and calculates all the risks in the cooperation with the customer. The generative AI also analyses consumers' details that don’t have a previous credit history. These applications are the major driver of the adoption of generative AI in the fintech sector

End-Use Insight

Based on End-Use, retail and banking firms use generative AI for models to train know-your-customer (KYC) processes at the time of account opening. The technology will efficiently search through non-numerical loan application data such as business plans. Generative AI will accelerate back-office tasks, such as answering performance questions in real time. It can help with situation analysis under multiple economic conditions. For example, investment banking will generate a stress-test situation for illiquid financial products to inform the proper accordance measures and reduce cost. Generative AI will stimulate multiple client needs and economic situations so financial advisors can give situation-specific financial recommendations.

For more insights on the historical and Forecast market data from 2016 to 2032 - download a sample report at https://market.us/report/generative-ai-in-fintech-market/request-sample/

Market Segmentation

Based on Component

- Service

- Software

Based on Deployment

- On-Premises

- Cloud

Based on Application

- Credit Scoring

- Compliance & Fraud Detection

- Personal Assistants

- Asset Management

- Predictive Analysis

- Insurance

- Debt Collection

- Business Analytics & Reporting

- Customer Behavioral Analytics

Based on End-Use Industry

- Retail Banking

- Investment Banking

- Stock Trading Firms

- Hedge Funds

- Other Industries

By Geography

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Market Key Players:

- Open AI

- Microsoft Corporation

- Google LLC

- Genie AI Ltd.

- IBM Corporation

- MOSTLY AI Inc.

- Veesual AI

- Adobe Inc.

- Synthesis AI

- Other Key Players

Recent Development of the Generative AI in Fintech Market

- June 2022, a developer of AI-driven Anti-Money Laundering (AML) software has partnered with fraud management company SEON to include real-time fraud prevention capabilities in AML compliance software. To include real-time fraud prevention solutions, SEON will be available through Licinuity’s platform, providing customers with compliance risk services from transaction monitoring to real-time fraud detection and prevention.

- April 2022 - Cross River and Sardine have partnered to build critical risk and payments infrastructure for Fintech, Web3, and Crypto companies. Sardine will leverage Cross River's payments platform as part of its integrated fraud prevention software for fiat and crypto transactions.

Related Reports:

- Generative AI Market is estimated to register the highest CAGR of 31.4%. It is expected to reach USD 151.9 billion by 2032.

- Generative AI in Marketing Market was valued at US$ 1.9 Billion in 2022. Between 2023 and 2032, this market is estimated to register the highest CAGR of 28.6%.

- Generative AI in Music Market is estimated to register the highest CAGR of 28.6%. It is expected to reach USD 2,660 million by 2032.

- Generative AI in Business Market was worth USD 1.2 billion in 2022. This market is expected to reach USD 20.9 billion by 2032 with a CAGR of 33.5% in the forecast period of 2023-2032.

- Generative AI in Gaming Market was valued at USD 922 Mn in 2022. Between 2023 and 2032, this market is estimated to register the highest CAGR of 23.3%.

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog: