Discover top fintech news and events!

Subscribe to FinTech Weekly's newsletter

Read by executives at JP Morgan, Coinbase, Blackrock, Klarna and more

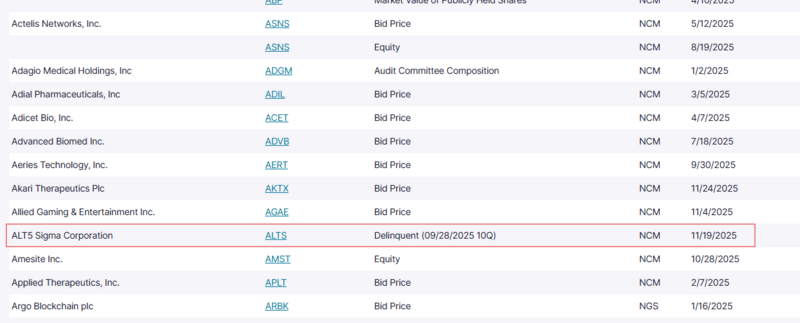

Alt5 Sigma is under heightened scrutiny after Nasdaq notified the company that it is no longer meeting continued listing requirements. The exchange placed the firm on its roster of noncompliant companies following its failure to file a third-quarter Form 10-Q with the Securities and Exchange Commission. While the notice does not affect trading of its shares for now, it adds weight to an already complex period for the business.

Nasdaq’s letter gives the company until January 20, 2026, to present a plan to regain compliance. If the exchange accepts that plan, Alt5 Sigma could receive an extension of up to 180 days from the original deadline. The firm said the notification was anticipated and stressed that its listing remains intact, but the disclosure deepens concerns around the company’s recent operational and reporting challenges.

Source: Nasdaq - Noncompliant Companies

Late Filings and Auditor Ambiguity

Alt5 Sigma attributed its delayed quarterly report to an ongoing internal review first outlined in an August filing. That earlier document covered issues tied to board structure, compensation, a bylaw amendment affecting quorum requirements, a judgment against a subsidiary in Rwanda, and the personal bankruptcy of a former chief financial officer. At the time, the firm also pointed to complications involving its independent accounting provider.

The situation grew less clear when the company informed regulators that its auditor, Hudgens CPA, resigned on November 21. The accounting firm’s partner said he had communicated his intention to step down months earlier, noting that his firm had completed the second-quarter review in August and had discussed potential successors with Alt5 Sigma. Whether a replacement has been formally engaged remains uncertain.

Compliance experts commonly view late filings as early warnings of internal strain. When an accounting firm’s departure coincides with a missing report, investors often look for additional information to understand the company’s broader financial controls.

Links to World Liberty Financial and the Trump Family

Alt5 Sigma drew significant attention earlier this year when it entered a $1.5 billion arrangement with World Liberty Financial, a cryptocurrency venture co-founded by Donald Trump Jr., Eric Trump, and Zach Witkoff. The deal involved the accumulation of $WLFI tokens and a stock issuance that allowed the crypto project to obtain a substantial stake in Alt5 Sigma without a cash transfer. Instead, the payment consisted of tokens priced at $0.20 each, while the company raised the remaining funds through a registered offering.

Read more:

- Trump Media Executives Launch $179M SPAC Aimed at Crypto and Blockchain Deals

- Trump’s World Liberty Financial to Launch Stablecoin ‘USD1’ Amid Crypto Ambitions

- Trump’s World Liberty Fi Acquires EOS Tokens Amid Rebranding to Vaulta

As part of the agreement, World Liberty Financial gained the right to appoint board members and an observer. After discussions with Nasdaq, Alt5 Sigma adjusted those appointments to align with listing rules. A Trump-affiliated entity holds a large share of World Liberty Financial tokens and participates in proceeds from token sales, though the tokens themselves do not represent ownership rights.

World Liberty Financial markets its token as the governance instrument of its ecosystem. Early investors saw significant price appreciation before the token later declined from its peak. Because these assets do not confer equity, their valuation depends entirely on market interest and the project’s internal dynamics.

Leadership Changes and SEC Disclosures

Questions around the company’s governance intensified after discrepancies appeared in recent filings. Alt5 Sigma said in an SEC document that its chief executive officer was suspended effective October 16. Internal communications reviewed by outside sources show an earlier date—September 4—for that suspension, alongside the temporary leave of another senior executive. Under federal rules, companies must disclose the effective date of such changes within a short window, and inconsistencies can raise compliance concerns.

The firm reported further changes ahead of the Thanksgiving holiday. It said its acting CEO and CFO had been terminated without cause, a consulting arrangement for its chief operations officer had ended, one board member had resigned, and a special committee had delivered its findings before being dissolved. Several individuals involved in these shifts did not respond to requests for comment.

With ongoing reviews touching on overseas legal matters and internal management issues, the company is expected to release additional information once it completes its outstanding filing obligations.

What Comes Next

Alt5 Sigma’s plan to regain compliance must be submitted within weeks. Nasdaq will then determine whether the path forward is sufficient or whether further action is needed. For now, the company remains listed, but the combination of delayed reporting, auditor turnover, executive changes, and the complex nature of its recent digital-asset partnership adds urgency to the situation.

In the coming months, investors will watch for the overdue Form 10-Q, disclosures about auditor engagement, and updates on the board’s ongoing review. For a company tied to a high-profile crypto venture and active on a major U.S. exchange, these steps will determine how much confidence the market places in its operations moving into 2026.