The power of Banking as a Service is that anybody can now design and deploy innovative, regulated financial products as effortlessly as building a Shopify website (BaaS). A massive technology shift is experienced by the Banking Industry due to continuous technological innovation and extensive online accessibility that plunged banks to get into the bandwagon of transformation.

However, banks initiated the process of Automation but they still find it challenging to move with the pace of today’s digitized customer-centric financial services. Traditional banking services are being obstructed by today’s financial technology to establish advanced multi-channel banking solutions. With everyday growing financial technology it has become easy to connect with today’s tech-savvy generation by offering digitally innovative solutions like digital wallets, P2P lending and Payments. Therefore, it is significant for banks to provide access to customers and re-innovate their approach to service delivery.

For traditional banks to stay ahead of their competition, banking as a service escorts them to relief by providing a toolkit which helps them quickly enter the digital market and accelerate the process to meet the advanced demands of today’s customers by offering an exclusive package of financial services.

Why Banks Should Consider BaaS?

Up until recently, businesses had to directly approach traditional banks to capitalize on their infrastructure. That's because they require bank accounts, at the very least, to retain client cash along with all the related back-end infrastructure for clearing, payments, and settlement.

Traditional banks, however, were not created with embedded financing requirements in mind. Building customized alliances and updating outdated technology are two steps in leveraging their infrastructure. It's time-consuming, expensive, and inconvenient, and it frequently needs the firm to have significant scale or resources before prospective partner banks would even consider them. Many of the market's recent entrants lack those resources outright.

Introducing BaaS. The basic building blocks of the usual banking infrastructure are constructed by BaaS providers and packaged for businesses. Then, businesses may quickly implement them to provide their clients with embedded banking and other financial services.

Companies may choose the infrastructure they want and personalize it to offer a more specialised experience since these components are given through elegant and consumable APIs. By selecting the best supplier for services like payments, KYC, treasury management, and so on, businesses can create a best-in-class financial tech stack without investing in their complicated infrastructure or navigating challenging agreements with traditional banks.

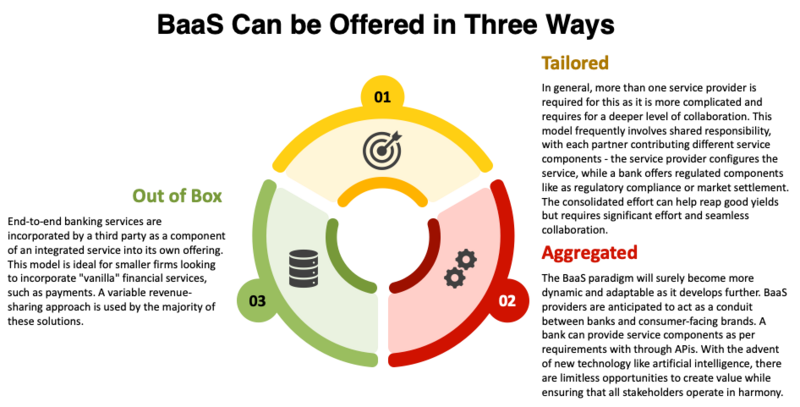

BaaS doesn’t come with one size fitall approach. Depending on the size, type and business operations of an organization, BaaS can be explored and implemented.

The basic three types of BaaS offerings are mentioned below in the chart.

What is Required for Banks to Embrace BaaS Model?

The following key aspects are requisite to understanding and leveraging the functioning of BaaS.

1. Strategically Established API Service

APIs aren’t new in the market, financial software providers offer clients (Banks) APIs to fulfil their business requirements by adapting the software. Recently, with the introduction of open-source software, vendors are being pushed to provide accessibility for customers who would want to use them. With an increase in open-source software momentum vendors started making more of their products for customers who are interested in accessing them via APIs.Instead of purchasing the whole entity buyers started using the software in a plug-and-play arrangement where they only pay for their usage.

This whole procedure is known as “Software as a service” which is now available for banks to provide API access to their users. Businesses now can customize their products, and pick from a wide range of financial services to fulfil their customer’s demands. In simple words, businesses are actively creating financial platforms to offer banking services to the general public. This functionality is known as Banking as a service.

Banks make use of APIs to allow sharing of data with Fintech and developers. This allows the third-party partners to create enterprise solutions like P2P lending, Digital wallets, mobile payments etc. for customers in need.

2. Open Banking with BaaS

Open banking technologies present a huge area of opportunity for businesses, provided they can deliver safe services and find the proper partners. Banking is being disrupted by BaaS, which enables new businesses to provide customers with better experiences and more options.

Open banking offers customers financial information and share access for the management of data owned by banks as well as involve customers in learning how to keep a check on their expenses. It enables customers to pick the best product that fulfills their requirements. Also, open banking allows customers ease of fund transfer.

Talking about the transactions, however, with open banking, a consumer must transact with a bank with whom he has an account, unlike with BaaS, even though he can obtain information about a transaction account's characteristics from several banks. BaaS enables users to access transaction services provided by any licenced bank, even if they are not current clients of that bank.

BaaS enables businesses to handpick the top-quality products from a variety of service providers without having to worry about maintaining a connection with each one of them. Even though they don't have an account with those banks, BaaS offers businesses speedier access, payment security, and other top-notch financial services through those banks.

3. User Experience

A shift in customer demand is seen over some time when they expect to be served quickly as possible. They require immediate solutions to their problems. When your business resonates well with the clients, be empathetic towards their pain points and resolve their queries as quickly as possible, you win loyalty and retention.

Financial services are a personal affair affecting the everyday lives of people. With a growing technology stack, customized financial offerings fulfil the modernized demands of customers. The end user doesn’t follow any thumb rule where they require to attain knowledge of BaaS before acquiring the products and services. What they’re concerned with is limited to the security, and safety of their offerings.

With the use of open banking technology, businesses in the financial and non-financial sectors may now access consumer accounts and data and provide new goods and services. BaaS even allows sharing of data with third-party providers. This makes it easier to create cutting-edge, highly relevant, customer-led digital products like virtual assistants and financial Robo advisers, for example. These digital solutions increase client interaction with your financial services, broaden your customer base, and boost customer retention while lowering expenses.

BaaS Benefits to Different Stakeholders

- BaaS assists organizations in generating more income by facilitating cross-selling opportunities due to API-driven facilities.

- Businesses may compartmentalize business logic and data with BaaS, which speeds up the development of new apps.

- Capitalizing on their own APIs as well as those of third parties allows businesses to develop considerably more.

- Using API ecosystems to build goods and services may significantly grow the customer base.

Closing Thoughts

BaaS has given banks and outside businesses a platform to expand their revenue streams. BaaS encourages traditional banks to become platform-based and modular to compete with other market players in the financial ecosystem's competitive climate. An innovative and profit-driven organisation has developed to support development as a result of escalating fintech competition, the usage of digital banking technologies like digital wallets, continuously changing customer expectations, regulatory restrictions, and compliance difficulties. BaaS offers opportunities to increase the customer base and improve the overall customer experience. BaaS will have a long-term impact on bank growth and has a promising future.