Photo by Documerica on Unsplash

2022 wasn’t the best year for centralized finance (CeFi). And it looks like 2023 isn’t going better.

The past year closed with a number of lawsuits that hit major centralized financial institutions and companies, along with some cases related to scams and unfortunately, fintech was involved.

In this article, we will cover the top 12 2022 lawsuits – and see why 2023 doesn’t seem to proceed better.

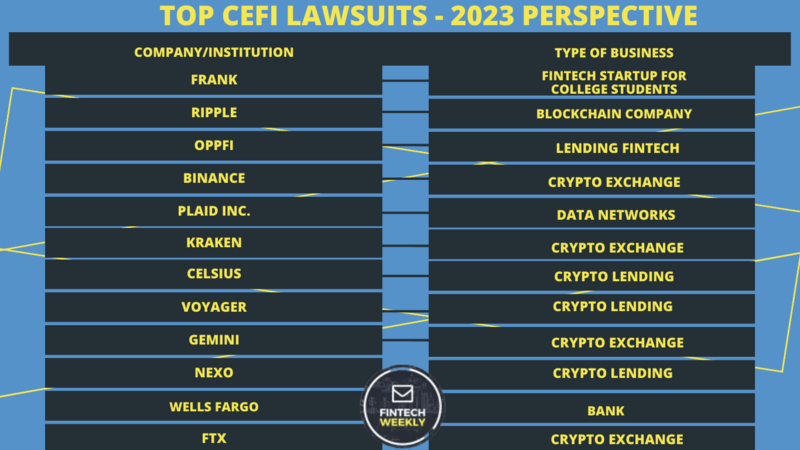

Top CeFi lawsuits in 2022

| Company / Institution | Type of business |

What happened & How regulators reacted |

| Frank | Frank was a fintech startup focused on helping college students to get financial aid. | The SEC charged Charlie Javice, founder of the startup, with fraud. |

| Ripple | Ripple Labs is a fintech company focused on using blockchain to simplify cross-border transactions. |

The SEC charged Ripple for allegedly using unregistered securities. |

| OppFi | OppFi is a fintech company focused on facilitating lending. | The company was sued by the DFPI in California and Texan authorities. In Texas, the class action against OppFi was dismissed. |

| Binance | Binance is the largest centralized crypto exchange. | The company was sued by both individual customers and US authorities for allegedly misrepresenting information and selling unregistered securities. |

| Plaid Inc. | Plaid Inc. is a fintech company specialized in creating data networks for financial services. |

The fintech company was sued for taking customers’ data without their consent. The US District Court for the Northern District of California imposed a $58 million fine and forced Plaid to change its privacy policies. |

| Kraken | Kraken is one of the most popular centralized crypto exchanges. | Kraken accepted, in 2023, to pay a fine worth $30 million imposed by the SEC. |

| Celsius Network | Crypto lending network. | The network was initially sued for lack of transparency and liquidity by a former investment manager. The company filed for bankruptcy in 2022. |

| Voyager Digital Ltd. | Crypto lending platform. | The company filed for bankruptcy in 2022, amid the crypto market collapse and the rising interest rates that made investors move to less volatile financial assets. |

| Gemini Trust Co. | Crypto exchange. | The company was sued by customers for allegedly selling unregistered securities. The company had to close its Gemini Earn program. |

| Nexo | Crypto lending platform and centralized exchange. | The platform was sued by several US states for allegedly selling unregistered securities. The company chose to pay a $45 million fine in 2023. |

| Wells Fargo | Bank. | Wells Fargo was sued by the Consumer Financial Protection Bureau (CFPB) for misconduct. The decisions taken by the bank were making people lose money and assets. The bank had to pay a record penalty worth $3.7 billion. |

| FTX | Crypto CeFi exchange. | The SEC charged Sam Bankman-Fried, CEO of the company, with fraud. Then, he was arrested. |

1. Frank Lawsuit

This lawsuit involves the popular bank JP Morgan and Frank, a fintech startup created to help college students who look for financial aid.

In 2021, this fintech startup was acquired by JP Morgan for $175 million. Problems arose when the bank started its email marketing process. It turned out that 70% of those emails bounced back: while the startup was sold with a customer base that amounted to over 4 million people, the real customers seemed to be only 300,000.

The bank sued Charlie Javice, founder of the fintech startup. In April 2023, the SEC (Securities and Exchange Commision), charged Javice with fraud for allegedly orchestrating a plan to provide false data, for what concerns both the number of customers and the success of the fintech in helping students.

2. Ripple Lawsuit

The case between the SEC and Ripple Labs started in 2020.

The blockchain company founded in 2012 was born to simplify and speed up cross-border transactions. In this case, the problem was the launch of the digital currency XRP: according to the SEC, the company launched an IPO (Initial Public Offering) to raise funds. The point is that the company used, according to the regulator, an unregistered security.

After a number of popular de-listings of XRP from centralized crypto exchanges (like in the case of Coinbase), and repartees, in 2022 Ripple got the support of several blockchain associations and companies: in fact, the fintech company accuses the SEC of undue and unreasonable control over the crypto industry.

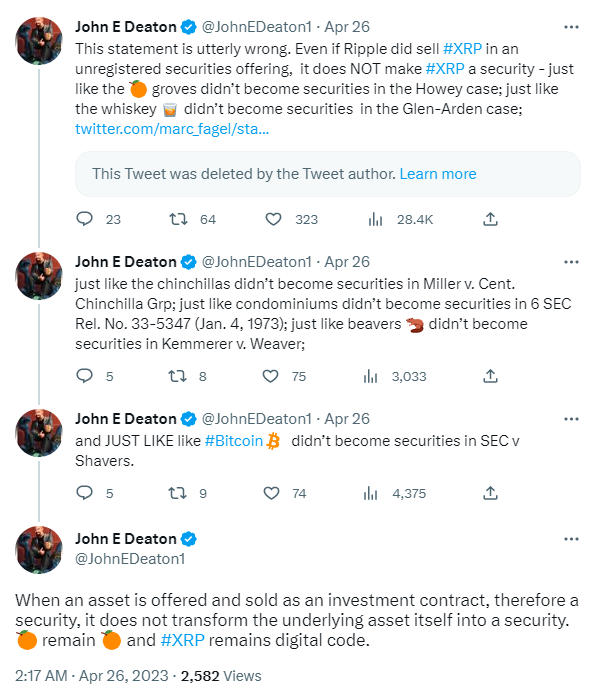

Recently, John E. Deaton, a legal expert, issued an Amicus Brief where he analyzed similar cases that occurred in past decades, and assessed that “when an asset is offered and sold as an investment contract, therefore a security, it does not transform the underlying asset itself into a security.”

The case is still ongoing.

Source: Twitter

3. OppFi (Opportunity Financial) Lawsuit

In 2022, the DFPI – the Department of Financial Protection and Innovation, sued OppFi, a fintech company focused on facilitating lending, for applying interest rates higher than the caps imposed in California.

While the state has a cap for interest rates that amounts to 36%, the fintech used to apply over 150% interest rates.

The fintech company replied that it operates under Federal laws that allow companies to fall under their state regulations – and the company is based in Utah.

During the same year, the fintech was involved in a similar litigation in Texas. In Texas, the class action against OppFi was dismissed in 2023, while the fintech still faces the same issue in California.

4. Binance Lawsuit

In 2022, Binance was sued by a Utah resident, Jeffrey Lockhart, for promoting Terra as a safe and fully fiat-backed cryptocurrency – the collapse of Terra proved that this wasn’t true.

This is only one of the lawsuits against the largest centralized crypto exchange, which is accused of selling unregistered securities by the Commodity Futures Trading Commission (CFTC).

Recently, the president of Ava Labs, John Wu, addressed the issue faced by crypto companies in the US saying that “The U.S. in terms of creating certainty is just falling behind everyone else”.

5. Plaid Inc. Lawsuit

The fintech company Plaid Inc., specialized in creating data networks for financial services, in 2022 was involved in a class action that accused the company of taking customers’ data without their consent.

The US District Court for the Northern District of California approved a $58 million settlement and forced the company to change its policies concerning privacy.

6. Kraken Lawsuit

Kraken is one of the largest centralized crypto exchanges available in the market. After facing troubles for being accused of selling cryptocurrencies in countries hit by international sanctions, was sued for the type of assets it sells – considered as unregistered securities.

Kraken has always tried to respect the principles behind cryptos – that is, the freedom they allow. But finally, in 2023 it accepted to pay a fine worth $30 million, imposed by the SEC, and to delist staking products.

7. Celsius Network Lawsuit

This crypto lending network was initially sued by Jason Stone, a former investment manager, who accused the network because he considered Celsius a fraudulent company. The reasons behind this were the lack of funds to fully cover deposits, and processes similar to Ponzi schemes: according to the manager, Celsius was inflating the price of CEL, the crypto associated with the network, to pay the higher interest rates promised to customers who chose to store more CEL.

Celsius actually did not have a strong financial infrastructure, and it filed for bankruptcy in July 2022, during the downturn that hit the crypto market and that forced other crypto businesses to close.

8. Voyager Digital Ltd. Lawsuit

Similarly, the crypto lender Voyager Digital filed for bankruptcy in 2022, after some of its over 3 million customers lost their money.

The lender was accused of improperly running the business: the rising interest rates imposed by US regulators, along with a crisis that made retail inventors move to less risky assets, created a liquidity problem for a lender without a healthy financial situation.

9. Gemini Trust Co. Lawsuit

In the case of the crypto exchange Gemini, the problem arose especially because of Gemini Earn, the program that allowed users to earn interest on their assets.

According to customers, the financial products were not in line with regulation concerning securities, working actually as unregistered securities, something that didn’t allow customers to fully assess risks.

The company had to shut down the program, and also delayed withdrawals because of liquidity issues.

10. Nexo Lawsuit

The crypto lending and centralized exchange platform Nexo was sued by eight US states – always for allegedly offering unregistered securities.

In January 2023, the fintech company chose to pay $45 million to the SEC.

11. Wells Fargo Lawsuit

The Consumer Financial Protection Bureau (CFPB) sued the popular bank Wells Fargo for misconduct related especially to the raise of interest without prior notice, repossessed cars (without notice) in case of loans, even when they didn’t have the right to do that, and the same applied to houses in cases of mortgage.

This conduct made people lose money, houses and cars.

In 2022, the bank agreed to pay a record penalty: $1.7 billion for the civil penalty, plus another $2 billion to customers.

12. FTX Lawsuit

FTX represented one of the most impressive collapses in crypto space. It turned out that this exchange, founded and managed by Sam Bankman-Fried, was just a way for its founder to get money to spend it in political donations, houses and to make risky investments.

All this was possible because Bankman used to divert customers’ funds to his private hedge fund, Alameda Research. The SEC charged Bankman with fraud and he was arrested.

The state of CeFi - Let's draw some conclusions

All these lawsuits, along with the banking crisis that hit the industry in 2023, didn't positively contribute to the reputation of centralized finance.

Most of the lawsuits we listed have to do with crypto and blockchain companies, but these still fall under the category of CeFi since their management is not decentralized and distributed, but centralized and under the control of single individuals.

All these lawsuits allow us to draw some conclusions, since in all cases there are some characteristics that help understand why these companies failed or were sued:

- Lack of transparency,

- Lack of proper and responsible management,

- Lack of funds,

- Falsification of data.

The case of Frank, for instance, tells us that it was too easy for a Fintech startup to be acquired, especially during the fintech boom that occurred right after the breakout of the pandemic.

In some other cases, like FTX, for instance, irresponsible management, more focused on personal advantages, and the lack of transparency were the main causes of the failure (even if, also in that case, there was a board of investors, and a public unprofessional behavior of the CEO).

And last, but not least, cases like Ripple, which have been lasting for years, still ongoing, and where regulators still didn't manage to produce evidence for their accusations.

In the meantime, customers and businesses involved continue to lose money, to have their funds blocked by delayed withdrawals – and it's not always possible to recover their funds.

Despite all this negative news and consequences, the situation doesn't seem to improve in 2023.

New lawsuits in the fintech industry – the CoinLoan case

Another crypto company is going to face troubles. Once again, this might have a domino effect – but this time we’re in Europe.

The Estonia-based CoinLoan, a crypto lending platform, was sued by the Estonian authorities and the business had to cease operations.

The platform received a Notice of restraint on April 24, 2023, and it had to halt any operations – including withdrawals – from April 25.

The funds of the crypto lending company can be moved only with the authorization of a provisional liquidator. According to the fintech company, the restraint was unexpected, and they have “no choice but to comply with the said requirements”.

Despite the need of a liquidator, the company didn’t file for bankruptcy. And it might be better for its customers not to reach that point.

We mentioned the domino effect because Vauld – another troubled crypto company that filed for bankruptcy in 2022 – is involved and is one of the many creditors of CoinLoan. In case of bankruptcy, the CoinLoan might receive financial protection until there is enough liquidity to repay creditors.

Bit4you – a Belgium-based crypto exchange – was also involved, and they’re ceasing operations since they used CoinLoan as a provider.

According to our sources, this might be one of those cases in which a crypto company lacks transparency – and honesty: actually, the problem might be related to the promise of over collateralized loans, while in reality offering under-collateralized loans.

This means that there might be a high probability of counterparty risk – something that happens when one of the parties can’t meet contractual obligations. In this case, CoinLoan is both blocking withdrawals and not paying interest on lended funds.

Final thoughts

CeFi failed again, and this time it’s even harder to swallow since many of the companies involved in lawsuits and litigations use cryptocurrencies and blockchain – a technology born to give people a more trustworthy financial system.

The point is that in most cases, the failure of the company wasn’t due to external factors, but to misconduct and irresponsible management.

Regulators chose to become more severe, and this can be a double-edged sword: if this means that it might be easier to cope with fraudsters, it also means that companies that choose to follow regulations can also be involved in litigations born from excessive (and sometimes unreasonable) control. Or, that companies might decide to move or avoid innovation in sectors that aren’t fully regulated yet.

In the meantime, the consequences for people and businesses can be dramatic.

If you want to stay ahead of competition and discover fintech news, insights and events, subscribe to FinTech Weekly Newsletter!